Imagine transforming a fleet of steel behemoths—those ubiquitous shipping containers that crisscross oceans—into pop-up shops, modular offices, or even eco-friendly housing complexes. In South Africa and across Africa, businesses and large-scale projects are doing just that, turning these rugged boxes into profitable assets.

But buying in bulk isn’t like grabbing a bulk pack of biltong at the local market; it demands savvy navigation through legal mazes, structural specs, and logistical landmines. This article dives into the nitty-gritty, blending technical details with practical tips to keep your venture afloat. You might also be interested in our pre-owned containers for sale.

First, let's size up the market

Africa’s containerized shipping sector is booming, with Sub-Saharan Africa’s market valued at USD 7.46 billion in 2025, projected to hit USD 9.79 billion by 2030, growing at a CAGR of 5.6%. In South Africa, the shipping containers market is set to expand at a 2.946% CAGR from 2024 to 2029, fueled by infrastructure development and rising trade. South African ports handled over 4.4 million TEUs (Twenty-Foot Equivalent Units) in 2022, with Durban alone managing 60% of the nation’s container traffic. For businesses eyeing bulk purchases—say, 10 or more units for a mining camp or retail expansion—this growth means opportunities, but also competition for quality stock.

Why buy in bulk?

Economies of scale slash costs dramatically. A standard 6m container in South Africa starts at R30,000, but bulk deals can drop that by 15-20% through negotiated supplier discounts. It’s like buying wholesale braai meat: more volume, less per kilo. Plus, uniformity ensures seamless integration in large projects, whether stacking them for vertical farms in arid Namibia or converting them into classrooms in rural Kenya.

Things To Consider

The legal landscape—Africa’s bureaucratic jungle. In South Africa, the Merchant Shipping (Safe Containers Convention) Act 2011 enforces the International Convention for Safe Containers (CSC), mandating valid CSC plates for all containers used in transport or structures. Importers need permits from Customs SA before shipment, with penalties for non-compliance.

Across Africa, regulations vary: Nigeria requires NAFDAC approvals for modified containers in food storage, while Kenya’s KEBS enforces ISO compliance. For structural uses, South Africa’s National Building Regulations Act 103 of 1977 demands compliance for conversions, including zoning approvals from local councils like Ekurhuleni, where containers on private land must align with town planning schemes.

Tip: Consult a customs broker early—failing to declare duties can turn your bargain into a budget-buster, with fees up to 20% of value.

Structurally, all containers must meet ISO 668 and ISO 1496-1 standards, ensuring they withstand 24-ton payloads and gale-force winds. In Africa’s harsh climates—from Sahara dust storms to Cape Town’s southeasters—corten steel construction resists corrosion, but check for CSC certification to avoid failures.

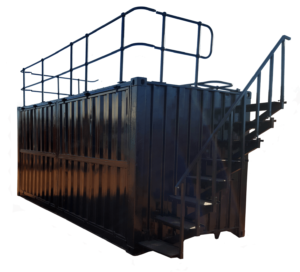

High-cube variants (9’6″ tall) offer extra volume for projects like data centers, but require reinforced foundations to handle stacking up to nine high. Practical tip: Inspect for dents, rust, and watertight seals; a Grade A used container might cost R35,000, versus R50,000 new, but ensure floor integrity via load tests—drop a 1-ton weight from 1m to simulate real use.

Infrastructure challenges? Africa’s logistics can feel like herding elephants through a keyhole. Ports like Durban face congestion, with vessel wait times averaging 5-7 days, exacerbated by poor rail links—only 20% of containers move by rail, the rest by road, where potholes and border delays inflate costs by 30-50%. In West Africa, customs inefficiencies add weeks, with logistics costs four times the global average. East Africa’s container shortages, up 5% in 2022 due to rerouting, hike prices.

Tip: Partner with firms like Container King for inland delivery; use flatbed trucks with cranes for offloading, and budget R5,000-10,000 per unit for transport from Durban to Johannesburg.

A Last Word

New vs. used? New ones shine for food-grade projects, but used save 40%—just verify history to dodge contamination. For large projects, lease first to test; rentals start at R2,000/month. Entertainment twist: Think of it as container speed-dating—swipe right on those with clean records.

Inspection is non-negotiable. Hire surveyors to check ISO compliance, using tools like ultrasonic thickness gauges for wall integrity (minimum 2mm corten). In humid coastal areas, opt for ventilated units to prevent mold. Transportation tip: Secure with twist-locks and chains; in Africa’s uneven terrain, use low-bed trailers to avoid tipping.

Costs fluctuate: A 20ft in SA averages R25,000-40,000, but bulk from China via Durban can dip lower, though add 15% for duties. Monitor trends—Africa’s 57% container traffic growth outpaces Asia’s 64%. Sustainability bonus: Recycled containers reduce carbon footprints by 80% versus new builds.

In conclusion, bulk buying shipping containers in Africa is a steel-clad adventure—profitable if you master the rules, specs, and hurdles. With practical steps like early legal checks and thorough inspections, your business can stack success, one container at a time. Just remember: In this game, the only thing rustier than a bad deal is ignoring the details.